QES Results: Decisions on hold

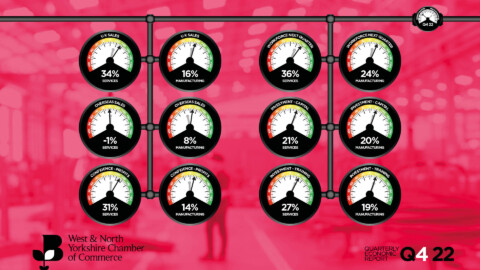

The message coming out of this quarter’s economic survey report is that companies across our region are in a holding pattern, awaiting the outcome of Brexit negotiations. Manufacturers reported increasing sales over the last quarter, both home and abroad, outperforming the national average. Some of this has been attributed to companies focusing on UK markets where customers higher up the supply chain are looking for a degree of certainty with regards delivery times and prices. Service sector businesses continue to record growth in domestic sales although the pace slowed in the last quarter, down slightly from its four year peak last quarter. Employment across the service sector remains strong also with 44% of companies attempting to recruit in the first quarter of 2019. There are strong indications that manufacturers are stockpiling and building inventory in order to stave off any negative outcomes of a disorderly exit from the European Union. Of course this ties up cash, making companies a little less agile and potentially harming their ability to respond positively to opportunities and threats.  Speaking about the results, Chamber chair, Gerald Jennings, said: “Despite the positives, we cannot ignore the uncertainty caused by Brexit. Business confidence is now down to levels last seen in 2016. Against a backdrop of slowing global growth and Brexit uncertainties, investment in plant and machinery slowed markedly in the last quarter across the region as companies hold off major purchases until they better understand what trading conditions they face. The underlying economy remains strong but decision-making has been paused, at least for the time being. Politicians must now do all they can to provide clarity and certainty, putting country ahead of party, in order to give companies the confidence to know that their investment decisions will not be derailed by unexpected consequences surrounding Brexit.” Download the latest report here Survey Summary Domestic sales– The pace of growth in service sector sales slowed a little in the last quarter with net balance down 8 points to +29%. Manufacturers reported increases in the first quarter of 2019, up 10 points to +27% Export sales– Service sector companies recorded a small decrease in overseas sales down 3 points in the last quarter. Manufacturers reported a 16 point increase in the last quarter to +30%, the sector export sales have trended upwards since Q2 2017 Employment – Employment remains strong across the region, although the pace of growth has slowed for the second successive quarter within the service sector. Manufacturers reported an increase in net balance in the last quarter Investment – Falls in investment in plant and machinery has trended downwards for the last four quarters across all sectors. Training investment also slowed across the service sector but increased a little within the manufacturing sector. Business confidence – Expectations of increasing turnover and profits slowed across all sectors in the last quarter, down to levels we last saw around the time of the EU referendum. Uncertainty is clearly playing on the minds of businesses in our region.

Speaking about the results, Chamber chair, Gerald Jennings, said: “Despite the positives, we cannot ignore the uncertainty caused by Brexit. Business confidence is now down to levels last seen in 2016. Against a backdrop of slowing global growth and Brexit uncertainties, investment in plant and machinery slowed markedly in the last quarter across the region as companies hold off major purchases until they better understand what trading conditions they face. The underlying economy remains strong but decision-making has been paused, at least for the time being. Politicians must now do all they can to provide clarity and certainty, putting country ahead of party, in order to give companies the confidence to know that their investment decisions will not be derailed by unexpected consequences surrounding Brexit.” Download the latest report here Survey Summary Domestic sales– The pace of growth in service sector sales slowed a little in the last quarter with net balance down 8 points to +29%. Manufacturers reported increases in the first quarter of 2019, up 10 points to +27% Export sales– Service sector companies recorded a small decrease in overseas sales down 3 points in the last quarter. Manufacturers reported a 16 point increase in the last quarter to +30%, the sector export sales have trended upwards since Q2 2017 Employment – Employment remains strong across the region, although the pace of growth has slowed for the second successive quarter within the service sector. Manufacturers reported an increase in net balance in the last quarter Investment – Falls in investment in plant and machinery has trended downwards for the last four quarters across all sectors. Training investment also slowed across the service sector but increased a little within the manufacturing sector. Business confidence – Expectations of increasing turnover and profits slowed across all sectors in the last quarter, down to levels we last saw around the time of the EU referendum. Uncertainty is clearly playing on the minds of businesses in our region.